/cloudfront-us-east-1.images.arcpublishing.com/pmn/GNFJK3FKRREOHOEAJYOJ7DX7Y4.jpg)

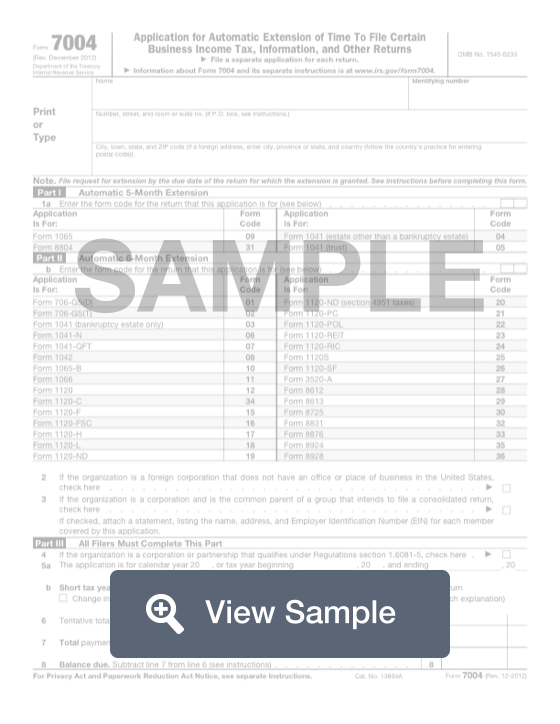

If you do not make the required 100 payment by Februor you do not file your Return by Apyour Request. We cannot guarantee the accuracy of this translation and shall not be liable for any inaccurate information or changes in the page layout resulting from the translation application tool.įorms, publications, and all applications, such as your MyFTB account, cannot be translated using this Google™ translation application tool. To qualify for a 60-day extension to file your 2021 Return, you must complete and submit an extension request for each tax type AND pay 100 of your 2021 Annual Business Tax liability on or before February 28, 2022. For a complete listing of the FTB’s official Spanish pages, visit La esta pagina en Espanol (Spanish home page). These pages do not include the Google™ translation application. We translate some pages on the FTB website into Spanish. Those who need more time to file can request an extension to file.Taxpayers must request an extension to file by April 18, or they may face a failure to file penalty.

If you have any questions related to the information contained in the translation, refer to the English version. For most individual taxpayers the tax filing and payment deadline is Monday, April 18, 2022. Any differences created in the translation are not binding on the FTB and have no legal effect for compliance or enforcement purposes.

The web pages currently in English on the FTB website are the official and accurate source for tax information and services we provide. Consult with a translator for official business. This Google™ translation feature, provided on the Franchise Tax Board (FTB) website, is for general information only.

0 kommentar(er)

0 kommentar(er)